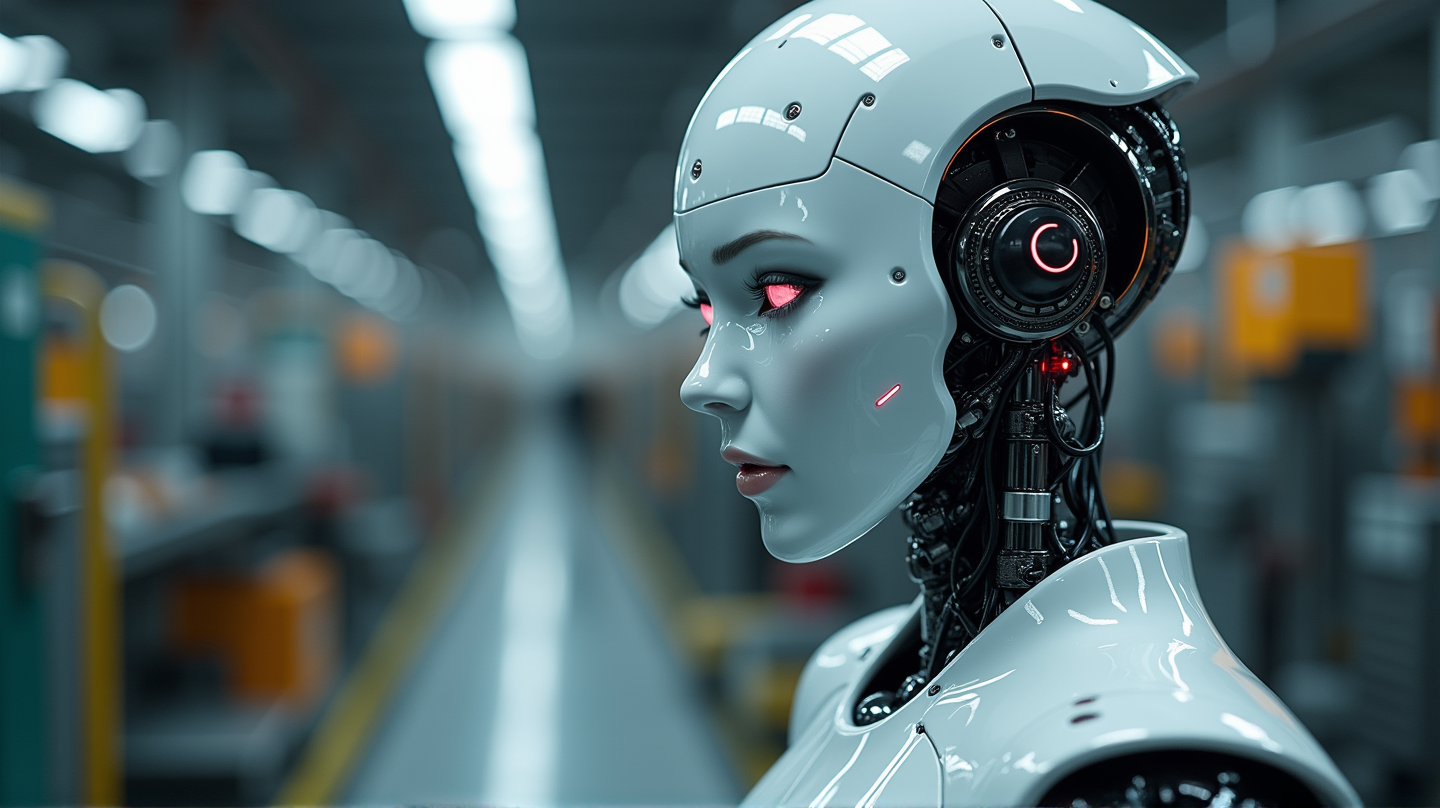

In the not-too-distant future, humanoid robots are set to become a cornerstone of industrial innovation, touching every corner of our economy. According to AInvest, the Roundhill Humanoid Robotics ETF (HUMN) plays a pivotal role in this evolution, aiming to harness a market expected to skyrocket to $5 trillion by 2050. This shift, once relegated to science fiction, is now grounded in the confluence of technological advancements and demographic demands.

A New Dawn: From Vision to Reality

The transition from niche to mainstream in humanoid robotics hinges on an aging population and persistent labor shortages across various demanding sectors. Furthermore, AI and actuation breakthroughs are setting the stage for rapid deployment and acceptance of humanoid robots in everyday applications. Morgan Stanley’s compelling projection estimates that by 2050, these humanoid marvels will populate industries globally, orchestrating a revolution in productivity and efficiency.

The Heart of Investment: HUMN’s Strategy

The Roundhill Humanoid Robotics ETF (HUMN) smartly positions itself to capture upward trends by focusing on essential elements of the ecosystem. It invests in suppliers of vital components like AI chips, actuators, and rare materials, with companies such as NVIDIA and Melexis NV leading the charge. This diversified strategy within the ETF reduces individual stock volatility, allowing investors to benefit across the entire humanoid robot value chain.

Navigating the Skeptics: Is $5 Trillion Within Reach?

While the $5 trillion forecast by Morgan Stanley offers a thrilling perspective, not everyone is convinced. Skeptics doubt technological and cost-reduction milestones can be achieved on the scale needed. The envisioned price dip for humanoid robots—necessitating significant advances in AI safety and regulatory clarity—remains a formidable hurdle. Nevertheless, the HUMN ETF’s balanced portfolio helps counterbalance uncertainties while aligning with expected growth trajectories.

Investment Approaches: A Long-Term Vision

For seasoned investors seeking long-haul gains, HUMN offers an enticing entrée to a field with potential to revolutionize industries. The ambitious market size might seem formidable, yet even a modest realization of these predictions presents lucrative prospects. Adjustments in holdings and focus areas keep the ETF adaptive to ever-evolving market conditions.

Embracing the Unknown: A Strategic Leap Forward

Roundhill Humanoid Robotics ETF represents neither a blind wager nor a play for immediate gratification. It symbolizes a robust, calculated investment strategy amid fluctuating realms of technological progress and sectoral alignment. As the industry matures, the ultimate victors will likely be those who excel in scaling innovation and harmonizing AI with physical functionality. With HUMN, tomorrow’s breakthroughs belong to today’s visionaries.

Embrace this opportunity—not merely as a chance to invest, but as an invitation to partake in crafting the future landscape of human-robot collaboration.